2023: Will The Inflation End

As we all know that 2022 has been a period of instability and insecurity, It is an unfavorable combination that perfectly captures the state of the globe as 2023 begins. The Ukraine Russia Conflict has triggered the worst land conflict in Europe since 1945, the greatest nuclear threat ever since Cuban missile crisis, and the broadest set of sanctions since the 1930s. Rising food and energy prices are to blame for many nations’ greatest inflation rates since the 1980s and the largest macroeconomic problem of the contemporary age of central banking. Long-held convictions in the sovereignty and territorial integrity of borders, the non-use of nuclear weapons, low inflation, and the continuity of electricity in developed nations have all been challenged at once. This chaos is a result of the events combining together such as, geopolitical is the largest. The American-led post-war international order is under threat, most clearly from Mr. Putin and most significantly from the steadily deteriorating relationship between the US and China under President Xi Jinping. The steadfastness with which the United States and other European nations reacted to Russia’s assault may have given the West, and especially the transatlantic alliance, new life. The gulf between the West and the rest, however, has become wider. Most people on Earth reside in nations that oppose Western sanctions against Russia. The universal principles that underpin the Western system are explicitly rejected by Mr. Xi. The two largest economies in the world are beginning to economically decouple from one another. The impact of this will be globally.

In near future, it is possible to prevent a recession, but it’s extremely improbable. The only policy measures that could prevent a recession would raise inflation, creating the conditions for a future downturn that would be considerably worse. Today, it is even more crucial to seek value from planning rather than just making plans since the economic climate is still quite atypical and appears to be more susceptible to shocks. After the pandemic shock and the following policy reaction, the economy is still struggling. It seems doubtful that we will soon experience calm waters due to new problems brought on by a collision of setbacks and challenges such as strong labour markets, geopolitical energy shocks, and aggressive policy tightening. As the cost of necessities rises, people throughout the world are experiencing inflation at levels not seen in decades. The consequences could still worsen. Global inflation has been caused by a pandemic and conflict. According to the World Food Programme, an additional 70 million people globally have been pushed toward hunger. The consensus estimate for core inflation in 2023 increased from 3.1% to 3.5%. Officials predict that unemployment will increase higher than it did in September of this year.

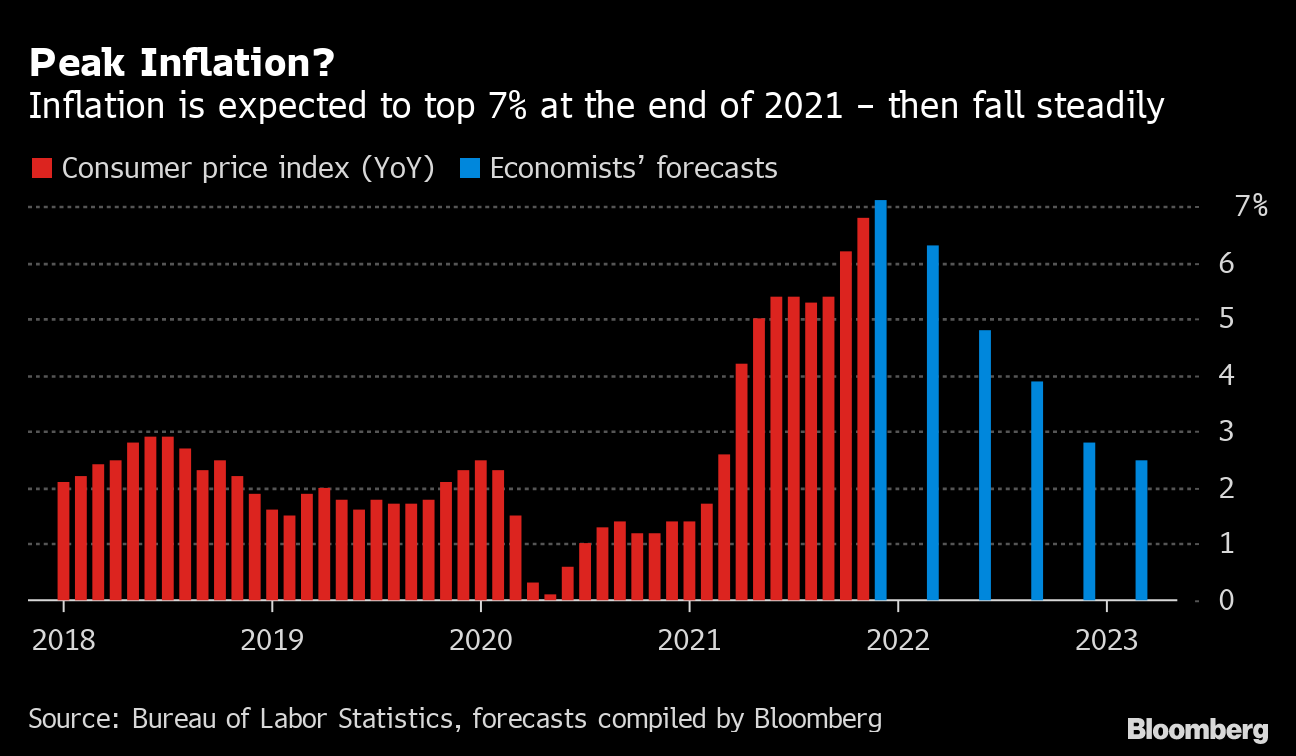

One of 2022’s most significant headlines was the rise of inflation. A new global recession has been brought about by a number of interconnected problems, including rising oil and food costs, fiscal instability following the epidemic, and consumer uncertainty. It is predicted that worldwide inflation will reach 7.4 percent in 2022. Since 1996, the inflation rate has increased annually at its greatest rate. In many nations, the increase in energy costs was the primary cause of inflation. Household spending on goods and services is being constrained by rising costs. This may make it difficult for those who are less wealthy to pay for necessities like food and housing. In the world economy and international finance, the US dollar has a significant influence. And at this moment, it is stronger than it has been in the past 20 years. The dollar is viewed as a secure investment in any economic environment. During a turbulent time, a worldwide pandemic.